GO Bond Loan Authorization

Overview of GO Bonds

Every two years, the City of Baltimore must get permission from voters through a ballot referendum to issue General Obligation Bonds (GO Bonds). GO bonds are borrowed funds that are used for capital projects, including housing and neighborhood revitalization; school renovations and improvements; economic development; improvements to City parks, recreation centers, and other government facilities; and key City institutions and cultural attractions.

Every two years, the City of Baltimore must get permission from voters through a ballot referendum to issue General Obligation Bonds (GO Bonds). GO bonds are borrowed funds that are used for capital projects, including housing and neighborhood revitalization; school renovations and improvements; economic development; improvements to City parks, recreation centers, and other government facilities; and key City institutions and cultural attractions.

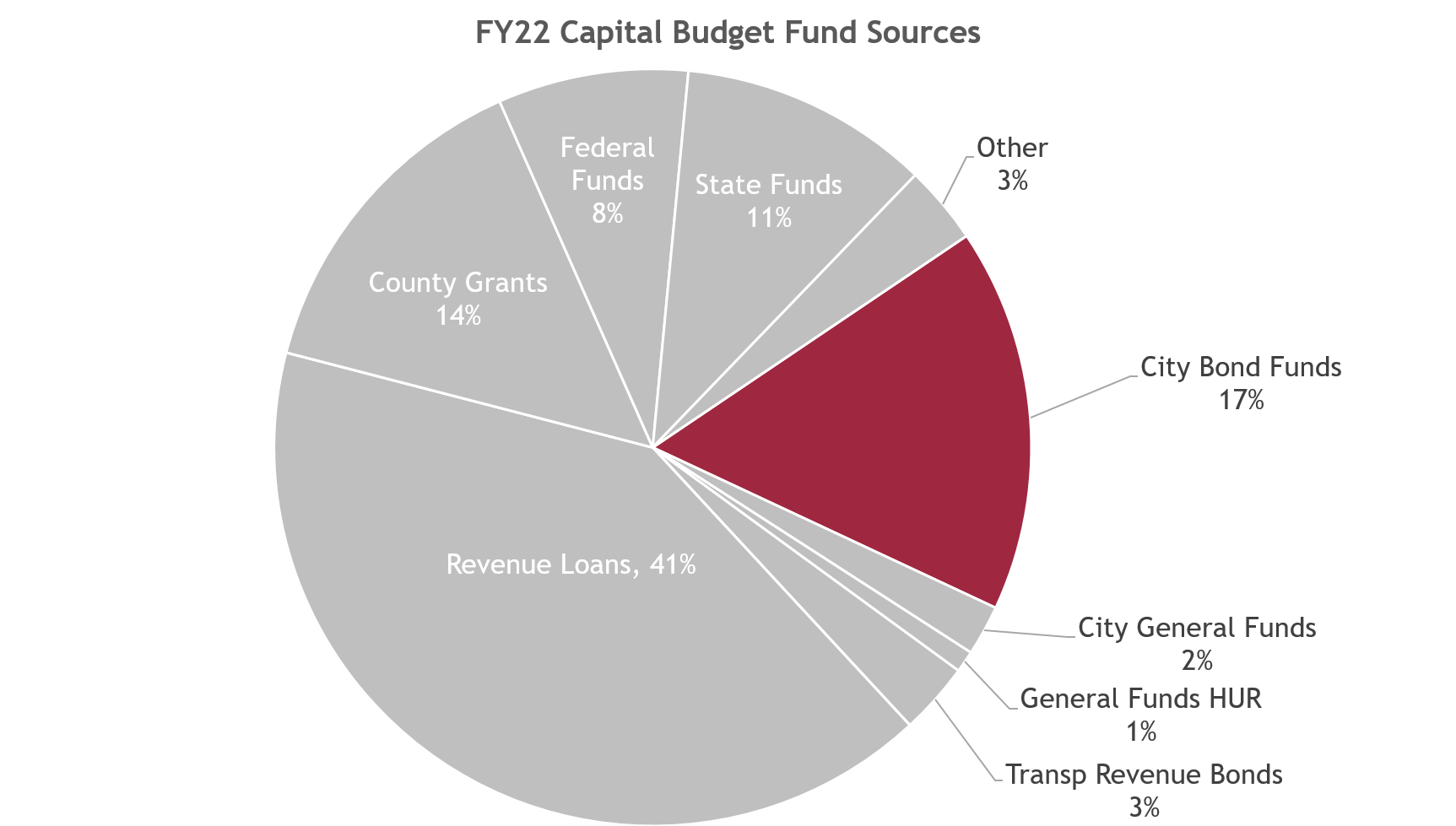

GO bonds make up a small but important part of the City’s capital budget. They allow the City the flexibility to fund priorities, particularly for projects and items for which there are no other fund sources available.

Issuing GO bonds to pay for capital projects is a common practice across cities in the United States. Because this type of bond is backed by the full faith and credit of a city, meaning that the city will use its taxing authority to repay the bonds in the unlikely event of a default, voters are often asked to vote to authorize a city to issue up to a certain about of GO bonds through questions on the general election ballot. The questions are sometimes referred to as loan authorizations, as voters are authorizing the City to issue debt that will be paid back over time. Each bond issue question refers to a “loan” dedicated to a broad purpose, such as affordable housing or community and economic development. See below for more information on the 2024 loan authorization for detail on each of the bond issues, or loan questions. Specific projects that are funded by the GO bonds are determined during the regular annual capital improvement program planning process. The actual amount of GO bonds budgeted in a given year will be proposed by the Department of Finance and approved by the Board of Finance annually.

The process to determine the categories that become the bond issue questions on the ballot begins with the Planning Commission in the fall of the year prior to a general election. For the 2024 loan authorization, which determines the amount of GO bonds that will be issued for the fiscal years 2026 and 2027 budgets, the process started in fall 2023. After Planning Commission approval, the questions were approved by the Board of Finance, Board of Estimates, and the City Delegation to the Maryland General Assembly. The City Council will hear the questions, and upon its approval they will be placed on the general election ballot for voter approval.

2024 Proposed Loan Authorization (November 2024 Ballot)

Question A: Affordable Housing Loan ($20 million over 2 years)

The Affordable Housing Loan sets aside funds exclusively to be used for affordable housing. Eligible uses include acquisition, preservation, production of new housing, demolition, rental assistance, housing counseling and project finance comprised of loans (including forgivable or fully amortizing) or grants as well as other related activities. These funds could be used to support the Affordable Housing Trust Fund.

Question B: Schools Loan ($55 million over 2 years)

Baltimore City Public Schools, the City of Baltimore, the State of Maryland, and the Maryland Stadium Authority are partnering to implement the 21st Century Schools initiative, a nearly billion dollar initiative to renovate or replace 28 school buildings. This loan authorization complements that investment by making critical systemic improvements, such as fire alarms, HVAC systems, and other urgent needs in schools that are not currently funded through the 21st Century Schools Initiative. This loan authorization also allows renovation and replacement of additional schools to take place, leveraging traditional State capital support through the Maryland Public Schools Construction Program. This City contribution is used to match approximately $30-35 million in annual State funding through the Public School Construction Program for improvements to school buildings outside of the 21st Century Schools initiative.

Question C: Community and Economic Development Loan ($50 million over 2 years)

Baltimore is committed to supporting and promoting efforts to revitalize and stabilize neighborhoods and support investment that retains and attracts jobs in the City and increases tax revenues. Community and Economic Development funds will be used to attract and retain residents, jobs, and other investment. This loan is used to eliminate blight through strategic whole block demolition; provide financing and incentives for private investment; and improve the appearance of commercial and industrial areas.

Question D: Public Infrastructure Loan ($125 million over 2 years)

The Public Infrastructure Loan provides critical funds for upgrades to public infrastructure including parks, recreation centers, libraries, streets, bridges, courthouses, city office buildings, police stations, fire stations, solid waste facilities, and information technology.

For more information, please contact Kristen Ahearn at (410) 396-8357 or Kristen.ahearn@baltimorecity.gov.

Additional Background on Baltimore's G.O. BondsIn recent years, Baltimore City has been conservative in issuing G.O. Bonds. Based on a debt study conducted in 2023, the consultant stated the City could issue up to $125 million in G.O. bonds each year while maintaining a stable financial position and bond rating. In response to the study, the Director of Finance elected to increase the annual authorization up to $125 million beginning in 2026. Both Standard and Poor’s and Moody’s have confirmed their ratings, Aa2 and AA, respectively. These ratings reflect a sound financial condition allowing the City to enjoy very affordable interest rates on the City’s general obligation debt. In 2022, voters were asked to authorize $80 million in G.O. bonds per year for fiscal years 2024 and 2025, consistent with the City’s debt policy. The Debt Policy is subject to review at least every five years, or at such earlier time as may be recommended by the Director of Finance. |